Are you tired of feeling lost in the maze of 401(k)s and retirement planning?

Well, you’re not alone.

With the average person changing jobs every 4 years, over $3.1 trillion dollars have been left behind in old 401(k) accounts, quietly collecting hefty fees.

But fear not!

Beagle is here to be your financial compass, guiding you through the complexities of retirement savings with ease and expertise.

Let’s embark on a journey to unlock the full potential of your hard-earned money and secure your financial future.

What is Beagle and Why Should You Care?

Imagine having a smart, loyal companion by your side, sniffing out hidden treasures in your financial landscape.

That’s exactly what Beagle does for your retirement savings.

As your financial concierge, Beagle offers a suite of services designed to simplify and optimize your 401(k) management:

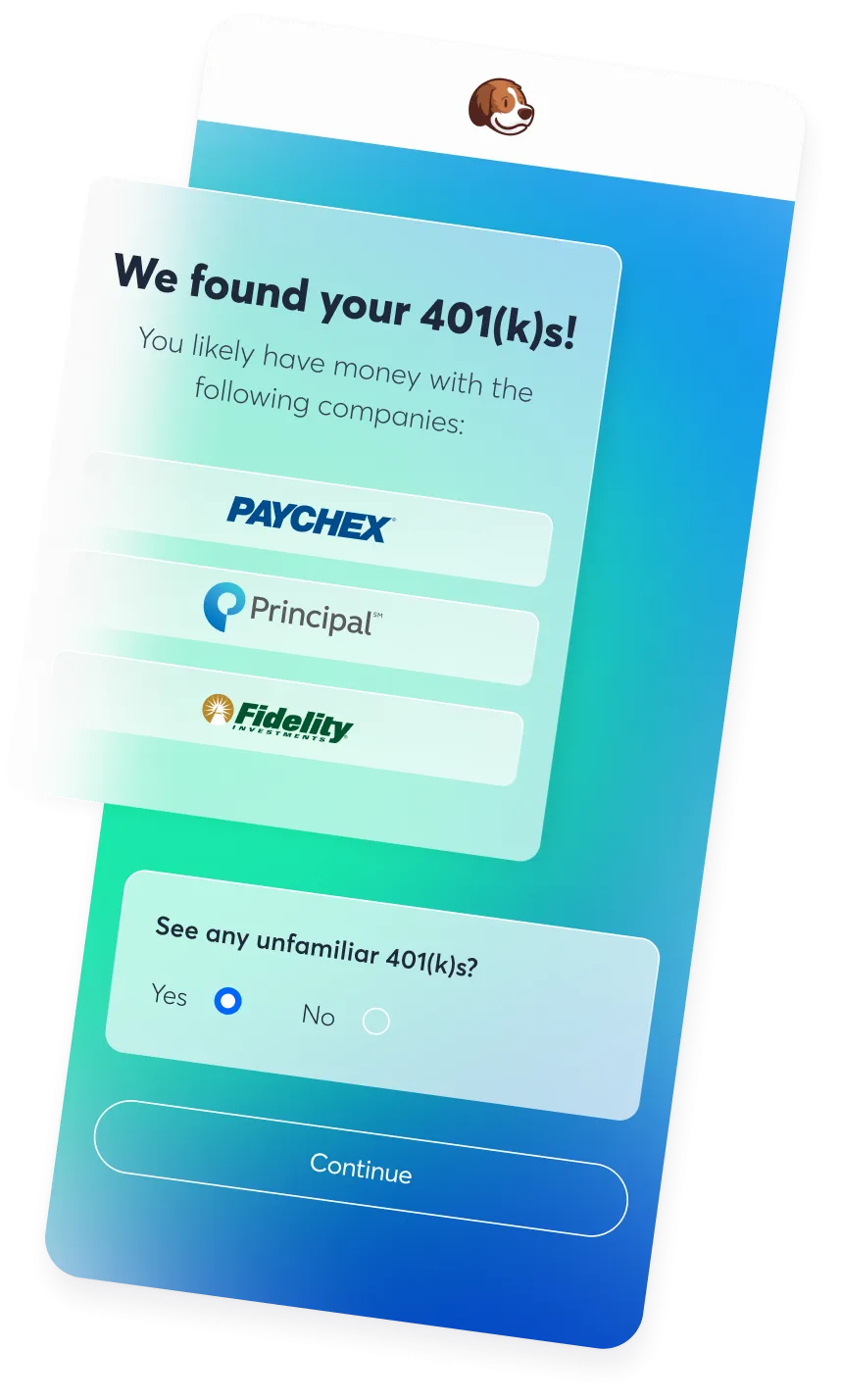

- Lost 401(k) Tracking: No more forgotten accounts gathering dust (and fees) in the corners of your financial past.

- Fee Detection: Uncover those sneaky hidden fees that are nibbling away at your nest egg.

- Effortless Rollovers: Consolidate your accounts with just a click, potentially saving thousands.

- 401(k) and IRA Unlocking: Access your old accounts at 0% net interest, because why pay high interest elsewhere when you’ve got your own money?

what you get

what you get

Your financial future, all in one place with Beagle

The Hidden Treasure of Lost 401(k)s

Did you know that the average 401(k) account is worth a whopping $112,300?

That’s not chump change – it’s a significant chunk of your retirement savings that could be lost in the shuffle of job changes and life transitions.

Beagle understands the importance of every penny when it comes to your future, which is why we’ve made it our mission to reunite you with your wandering wealth.

How Beagle Sniffs Out Your Old 401(k)s

- Quick Sign-Up: In just 3 minutes, you can set Beagle on the trail of your old accounts.

- Comprehensive Search: We leave no stone unturned, searching through various databases and contacting former employers.

- Consolidated Report: All your findings are neatly presented in one easy-to-understand dashboard.

Remember, finding your old 401(k)s isn’t just about reclaiming lost money – it’s about taking control of your financial future.

The Fee Frenzy: Are You Paying Too Much?

Here’s a shocking statistic: the average 401(k) charges a whopping 0.97% or more in fees!

Over time, this could cost you up to 28% of your retirement savings.

That’s right, more than a quarter of your hard-earned money could be going straight into someone else’s pocket.

Beagle’s Fee-Finding Mission

- Fee Analysis: We meticulously examine your accounts to identify all fees, both obvious and hidden.

- Cost Comparison: See how your fees stack up against industry benchmarks.

- Savings Potential: We’ll show you how much you could save by optimizing your accounts.

By understanding your fees, you’re taking the first step towards maximizing your retirement savings.

Knowledge is power, and in this case, it’s also money in your pocket.

The Magic of Consolidation: Simplify and Save

Picture this: all your 401(k)s and IRAs, neatly organized in one place.

No more juggling multiple accounts or worrying about lost paperwork.

That’s the beauty of consolidation, and Beagle makes it as easy as fetch.

Beagle’s One-Click Rollover

- Account Assessment: We evaluate your current accounts and recommend the best consolidation strategy.

- Effortless Transfer: With just one click, we initiate the rollover process.

- Fee Reduction: By consolidating, you could cut your current fees by up to 3x!

Consolidation isn’t just about convenience – it’s a smart financial move that could significantly boost your retirement savings.

Unlocking Your 401(k): Access When You Need It

Life doesn’t always follow our carefully laid plans.

Sometimes, we need access to our funds before retirement.

That’s where Beagle’s unlocking feature comes in handy.

How Beagle Unlocks Your Retirement Funds

- 0% Net Interest Loans: Borrow from your old 401(k)s and IRAs without the high interest rates of credit cards or personal loans.

- Self-Repayment: All interest paid goes back into your own account, keeping your money working for you.

- Flexible Access: Use your funds for what matters most to you, whether it’s paying off debt or investing in your future.

Remember, while accessing your retirement funds early should be done cautiously, it’s comforting to know you have options when you need them.

Real People, Real Results: The Beagle Difference

Don’t just take our word for it.

Here’s what some of our users have to say:

“I had no idea I was paying so much in fees! Beagle helped me save over $5,000 a year just by consolidating my old 401(k)s.” – Sarah T., Marketing Executive

“Finding my old 401(k) from my first job was like discovering buried treasure. Thanks to Beagle, I recovered over $50,000 I had completely forgotten about!” – Mike R., Software Engineer

These stories aren’t unique – they’re the kind of financial wins we help create every day at Beagle.

Your Next Steps: Unleash the Power of Beagle

Ready to take control of your financial future?

Here’s how to get started with Beagle:

- Sign Up: It takes just 3 minutes to create your account.

- Connect Your Accounts: We’ll securely link to your existing financial institutions.

- Sit Back and Relax: Let Beagle do the heavy lifting while you watch your financial picture come into focus.

Remember, every day you wait is another day your money could be working harder for you.

Don’t let hidden fees and lost accounts hold you back from the retirement you deserve.

hand

hand

Take control of your financial future with Beagle

In the world of personal finance, knowledge truly is power.

With Beagle by your side, you’re not just saving for retirement – you’re optimizing every aspect of your financial journey.

From finding lost accounts to slashing fees and simplifying your financial life, Beagle is the companion you need to navigate the complex world of 401(k)s and IRAs.

So why wait?

Take the first step towards financial freedom today.

Let Beagle be your guide, and together, we’ll ensure your retirement savings are working as hard as you do.

After all, you’ve earned it – now it’s time to make it count.